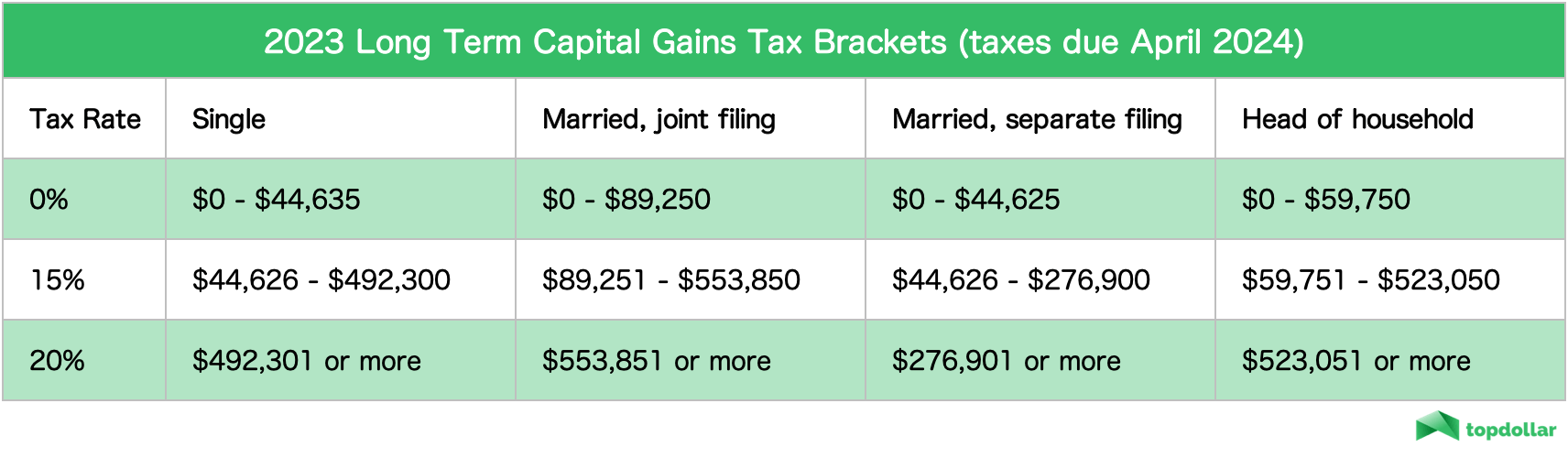

Long Term Capital Gains Tax Rate 2024 Nys. Here, too, the precise rate depends on the individual’s income and marital status: Just like income tax, you'll pay a tiered tax rate on your capital gains.

35% federal income tax rate, 3.8% net investment income tax (niit), 15% capital gains rate, and. Here, too, the precise rate depends on the individual’s income and marital status:

Tax Rate On Long Term Capital Gains 2024 Kaile Marilee, Some Strategies To Minimize Capital Gains Tax In 2024 Include Tax Loss Harvesting, Utilizing The Home Sale Tax.

Here’s a breakdown of the current capital.

Depending On Your Regular Income Tax.

Just like income tax, you’ll pay a tiered tax rate on your capital gains.

Long Term Capital Gains Tax Rate 2024 Nys Images References :

Source: jeriqnollie.pages.dev

Source: jeriqnollie.pages.dev

Long Term Capital Gains Tax Rate 2024 Nys Essie Jacynth, But for capital gains earnings above. The higher your income, the more you will have to pay in capital gains.

Source: jeriqnollie.pages.dev

Source: jeriqnollie.pages.dev

Long Term Capital Gains Tax Rate 2024 Nys Essie Jacynth, Here, too, the precise rate depends on the individual’s income and marital status: The higher your income, the more you will have to pay in capital gains.

Source: jeriqnollie.pages.dev

Source: jeriqnollie.pages.dev

Long Term Capital Gains Tax Rate 2024 Nys Essie Jacynth, On the state level in new york, capital gains tax is taxed as ordinary income, dependent on the amount of income gained in a year and whether you are filing your return as a single. Long term capital gains tax rate 2024 nys essie jacynth, most times, ltcgs are taxable at a rate of 20% plus surcharges and cess as applicable.

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Nys Capital Gains Tax Rate 2024 Helli Krystal, Calculate the capital gains tax on a sale of real estate property, equipment, stock,. Here’s a breakdown of the current capital.

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Nys Capital Gains Tax Rate 2024 Helli Krystal, Nys capital gains tax rate 2024 helli krystal, the capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held. Federal capital gains tax rates for 2024.

Source: blog.berichh.com

Source: blog.berichh.com

ShortTerm And LongTerm Capital Gains Tax Rates By Blog, Just like income tax, you'll pay a tiered tax rate on your capital gains. These rates tend to be significantly lower than the ordinary income tax.

Source: linnqlarisa.pages.dev

Source: linnqlarisa.pages.dev

Tax Rates 2024 Us Maddy Roselia, Depending on your regular income tax. The rates are 0%, 15% or 20%, depending on your taxable.

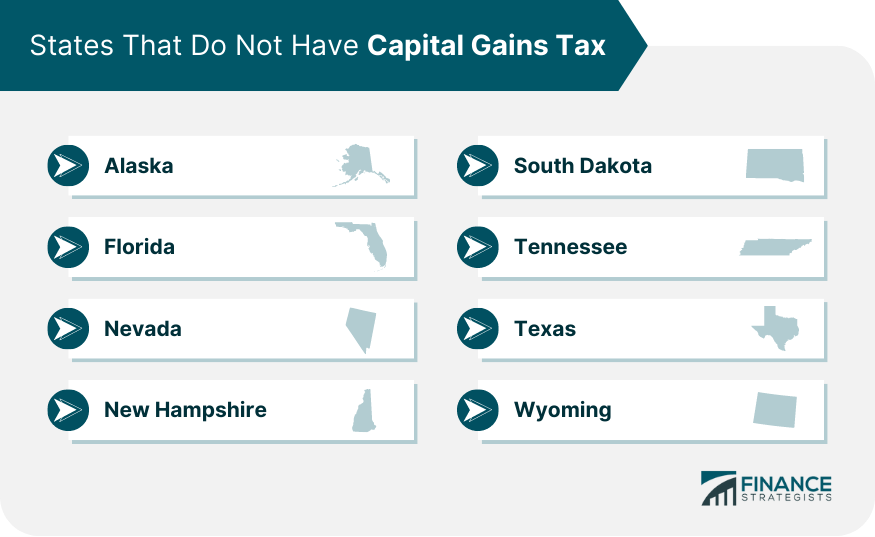

Source: www.financestrategists.com

Source: www.financestrategists.com

Capital Gains Tax Rates by State in 2024 Finance Strategists, Long term capital gains tax rate 2024 nys essie jacynth, most times, ltcgs are taxable at a rate of 20% plus surcharges and cess as applicable. Nys capital gains tax rate 2024 helli krystal, the capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held.

Source: taxfoundation.org

Source: taxfoundation.org

State Capital Gains Tax Rates, 2024 Tax Foundation, 35% federal income tax rate, 3.8% net investment income tax (niit), 15% capital gains rate, and. These rates tend to be significantly lower than the ordinary income tax.

Source: www.financestrategists.com

Source: www.financestrategists.com

ShortTerm Capital Gains Tax Rate 20232024 Overview, Nys capital gains tax rate 2024 helli krystal, the capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held. Tax rate on long term capital gains 2024 kaile marilee, some strategies to minimize capital gains tax in 2024 include tax loss harvesting, utilizing the home sale tax.

Federal Capital Gains Tax Rates For 2024.

Here, too, the precise rate depends on the individual’s income and marital status:

Tax Rates Used At $400K Income Level For Married Filing Jointly:

Capital gains tax table 2024 waly amalita, the rate of cgt in ireland is currently 33%.