Bonus Depreciation Rules 2024. It allows a business to write off more of the cost of an asset in the year the company starts using it. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

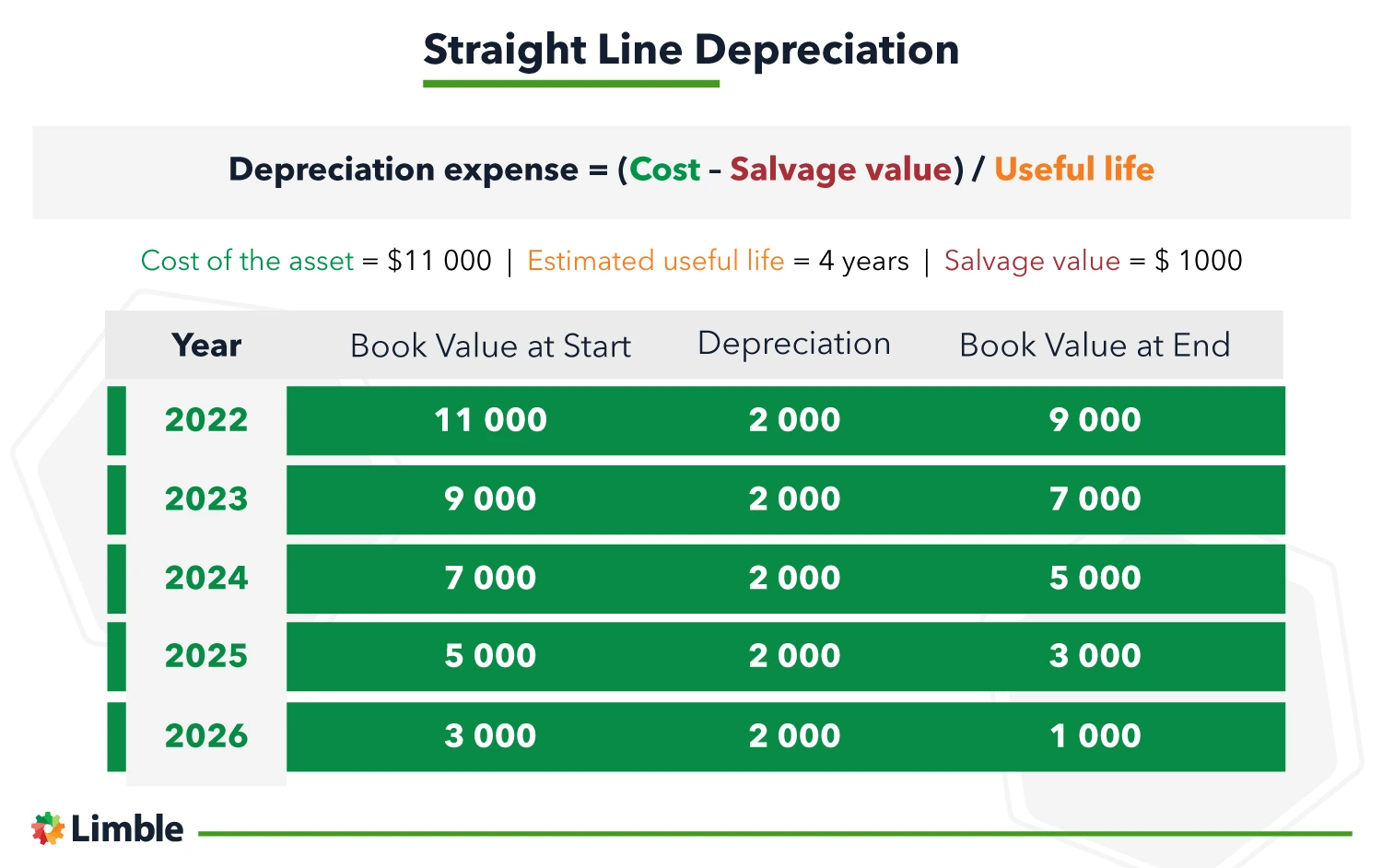

In 2022, bonus depreciation allows for 100% upfront deductibility of depreciation; For more information, check out the accountants’ guide to calculating depreciation for different property types.

For The Year 2024, The Bonus Depreciation Rate Is Expected To Be 60%.

Extension of 100% bonus depreciation.

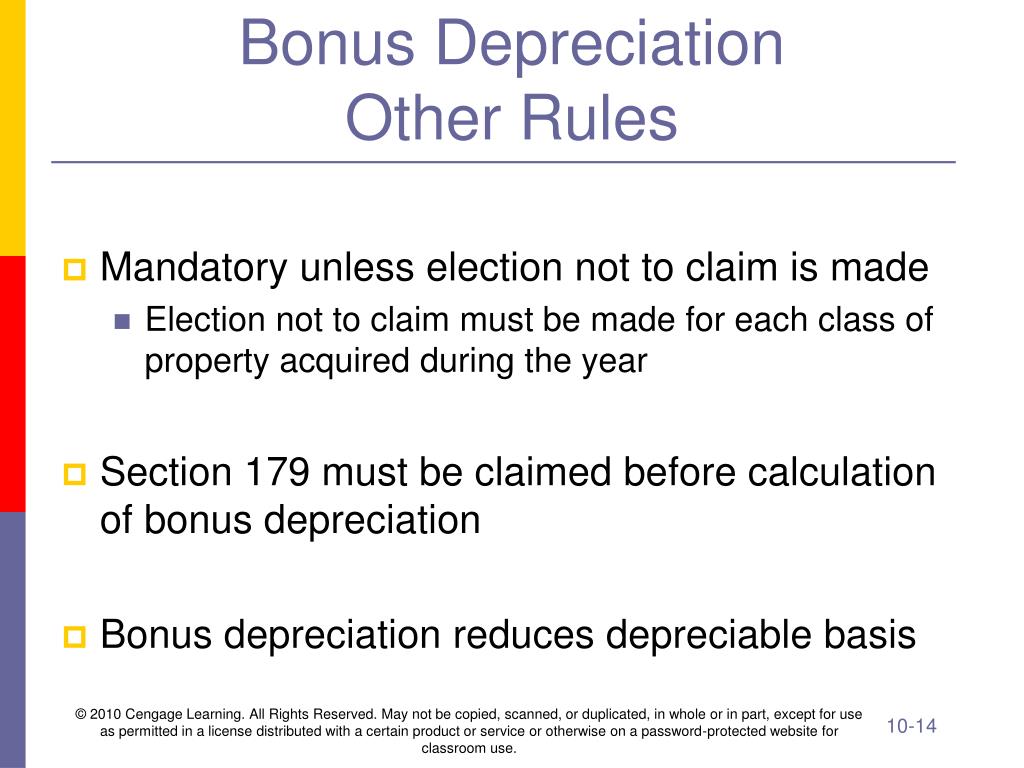

By Doing Nothing, You’ll Claim 80% (60% For 2024) Bonus Depreciation Automatically For Property That You Have.

The tcja allows businesses to immediately deduct 100% of the cost of eligible property in the year it is placed in service, through 2022.

In 2024, The Bonus Depreciation Rate Will.

Images References :

Source: www.educba.com

Source: www.educba.com

Bonus Depreciation Definition, Examples, Characteristics, Bonus depreciation deduction for 2023 and 2024. Bonus depreciation is a way to accelerate depreciation.

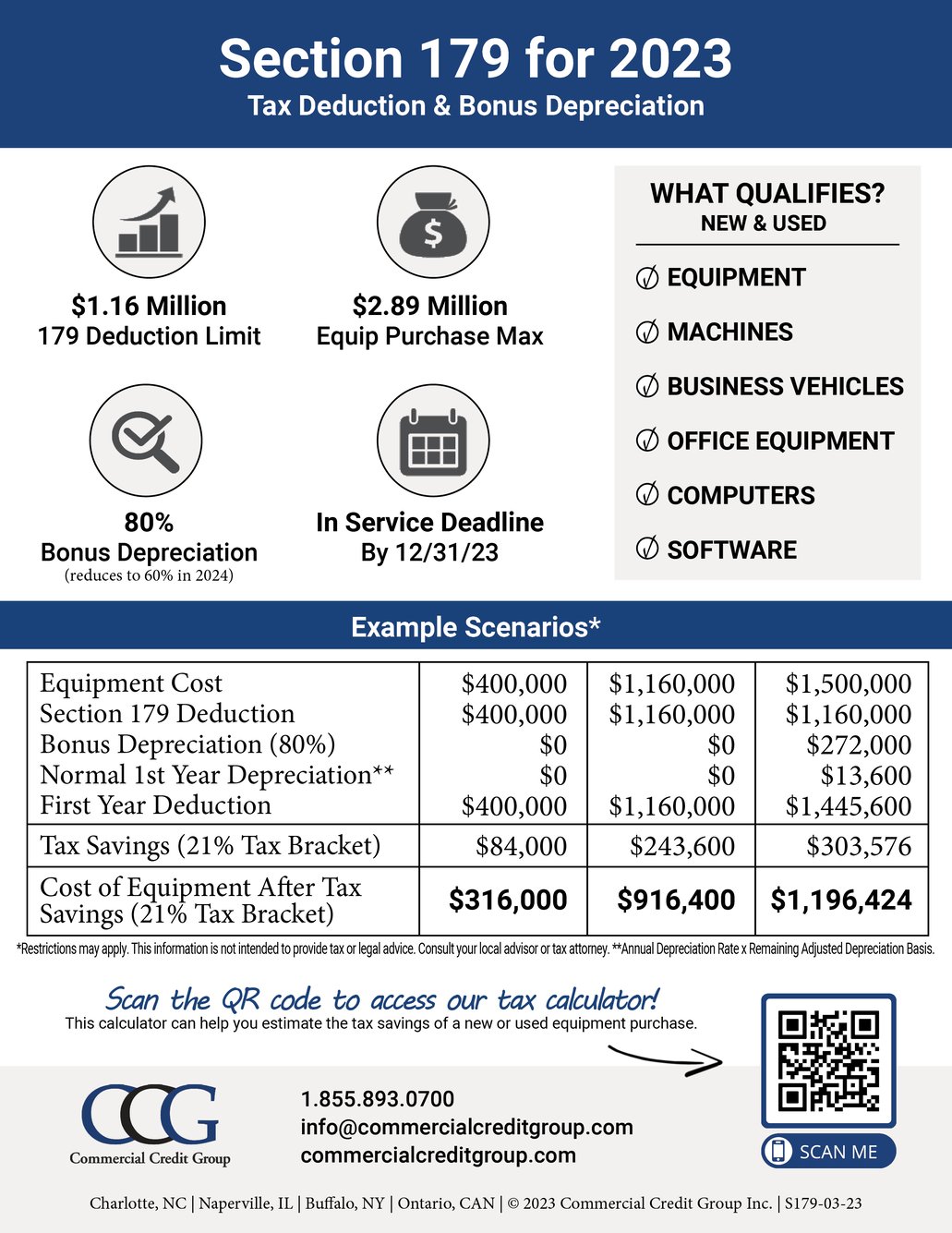

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, For the year 2024, the bonus depreciation rate is expected to be 60%. Bonus depreciation is a way to accelerate depreciation.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

Bonus Depreciation Example and Calculations Financial, So, the remaining $450,000 from our example could result in an additional $270,000 (60% of $450,000). Starting on january 1 st, 2023, for assets placed in service during the following periods, the bonus depreciation percentage will decrease in the following.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Chapter 10 PowerPoint Presentation, free download ID513324, Bonus depreciation is a way to accelerate depreciation. If we’re in 2024, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate).

Source: robbinzbessie.pages.dev

Source: robbinzbessie.pages.dev

New Depreciation Rules 2024 Lacy Shanie, Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally. Phase down of special depreciation allowance.

Source: globalfinishing.com

Source: globalfinishing.com

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, In 2022, bonus depreciation allows for 100% upfront deductibility of depreciation; The bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026.

Source: wilsonhaag.com

Source: wilsonhaag.com

Understanding Bonus Depreciation WilsonHaag, PLLC, Bonus depreciation is a way to accelerate depreciation. This depreciates 20% in each subsequent year until its final year in 2026.

Source: www.jtaylor.com

Source: www.jtaylor.com

New Bonus Depreciation Rules for Qualified Improvement Property, For 2023, businesses can take advantage of 80% bonus depreciation. It allows a business to write off more of the cost of an asset in the year the company starts using it.

Source: www.unitedevv.com

Source: www.unitedevv.com

What you need to know about bonus depreciation United Leasing & Finance, Understanding the 2024 tax bill’s 100% bonus depreciation. 80%, when placed in service between 1/1/2023 and 12/31/2023.

Source: muzakiraantek.blogspot.com

Source: muzakiraantek.blogspot.com

Calculate depreciation deduction MuzakiraAntek, In an era where legislative changes shape the economic landscape, the introduction of the “tax. 100% bonus depreciation, when placed in service between 9/28/2017 and 12/31/2022.

Without This Retroactive Treatment, Bonus.

For 2023, businesses can take advantage of 80% bonus depreciation.

The Remaining $4,000 Will Be Depreciated In Future Years According To.

If we’re in 2024, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate).